How to Find Undervalued Stocks | Undervalued.ai

After a decade of investing, I've consistently faced two challenges: finding time for research and cutting through the noise to get the most useful information. This led me to build a stock analysis system that combines quantitative filtering with artificial intelligence to identify value opportunities in the stock market. In other words, I use AI to identify great companies trading at reasonable prices compared to their estimated intrinsic value.

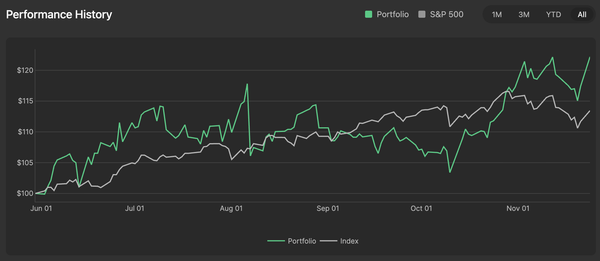

Note: This article focuses on the stock-selection methodology used by the AI hedge fund. Portfolio management is another, separate layer.

Finding undervalued stocks requires a comprehensive approach that considers multiple business dimensions. Below is the breakdown of the methodology that powers Undervalued.ai:

Narrowing Down a Massive Market

In-depth analysis of every publicly traded company in the world is extraordinarily complex and expensive. In particular, there's the complexity of different currencies, the different reporting formats, and, more importantly, the questionable reliability of data for some markets. As a result, I decided to narrow it down to equities listed on the NYSE, NASDAQ, and AMEX. Those stock exchanges host most major global companies and provide standardized, reliable data.

Peer Grouping and Assessment

In the background, an independent pipeline maps each company to a peer group. In practice, each peer group is defined by a combination of industry classification, market-cap range, and business model. The business model point is the trickiest and is what allows us to compare apples with apples. Indeed, even if two companies are similar in size within the same industry, you do not want to compare businesses with different business models.

Using the peer group, the system extracts fundamentals of the entire group and then ranks those companies on two dimensions:

- Their Growth. For example, their revenue growth, operating cash flow growth, EBIT growth, etc.

- Their Profitability. For example, their ROE, net profit margin, operating margin, etc.

The key idea is to use relative ranking rather than absolute benchmarks. Nothing is "absolutely" good or bad; it's always "good in comparison to" – context matters. This relative view is central to finding undervalued stocks: the goal is to identify businesses whose fundamentals rank well inside their peer group while their valuation does not fully reflect that quality.

For example, companies that score in the bottom quartile across multiple metrics relative to their peer group would receive a negative grading. This early scoring helps identify 'value traps' - companies that appear cheap but are, in reality, declining businesses with bad fundamentals.

Multi-Dimensional Analysis

Following this peer-scoring methodology, the stock enters the AI Analysis Pipeline. In essence, this pipeline is a team of specialized AI analysts, each focused on a specific dimension, with an AI manager coordinating their conclusions.

Here are the main dimensions in the current version of the system:

1. Financial Statement Analysis

Three specialized AI agents work in parallel to analyze financial statements over several years, with a focus on the most recent quarters. Each agent looks at a different part of the financial statements:

- One agent for the Balance Sheet structure and strength

- One agent for the Income Statement quality and growth patterns

- One agent for Cash Flow sustainability and capital allocation efficiency

2. Fundamental Synthesis

Then, another dedicated AI agent integrates the three findings and looks deeper into:

- Real earnings power (removing accounting distortions)

- Cash generation capability

- Quality of growth (organic vs. inorganic)

- Financial flexibility and operating leverage

I give more weight to fundamentals because numbers tell a story; AI can hallucinate if given too much data (hence the multi-layer); and narrative often remains optimistic while actual business performance deteriorates.

3. Peer Comparison Analysis

In parallel, an agent compares each stock with its direct industry competitors across several dimensions and looks into:

- Relative valuation using sector-appropriate multiples

- Competitive positioning assessment

- Profitability chain analysis

Definition: Profitability Chain Analysis examines how efficiently a company converts revenues into profits (gross margin → operating margin → net margin). For example, Apple's extraordinary gross margins highlight its pricing power. Costco's thin margins but high inventory turnover demonstrate its operational efficiency, etc.

4. Technical Analysis

Another AI agent looks at the technical component. In particular:

- Price momentum and reversal patterns

- Moving average relationships

- Volume patterns and confirmation signals

The system integrates those technical signals because they help identify entry points.

5. Macro-Environmental Analysis

Then, another set of agents examines how the company fits within the broader economic landscape.

- The interest rate sensitivity and inflation impact potential

- The global market trends and sector rotation patterns

- And the large flows to understand institutional movements

The objective here is to get a pulse of the market and how the company is likely to perform in this broader context.

6. Insider Trading Assessment

When multiple C-level executives or major shareholders start buying (or selling) their company's stock, it's definitely an interesting signal. Here again, another AI agent looks at several points, such as:

- The buy/sell patterns and timing

- The role/position of insiders involved. For example, the CEO or a cluster (coordinated action) would be weighted more than a director

- The size of transactions relative to holdings

7. Earnings Call Analysis

Although the Earnings Call is often carefully prepared, there is still valuable information to glean from it. For example, the AI agent would seek to:

- Compare the narrative with the financial reality

- Assess the tone and the confidence

- Identify the company's strategy for the near future

Final assessment

As a final step, another AI agent takes as input all previous AI-generated analyses, gives context, and then gives a final assessment with recommendations. In particular, this agent provides:

- A clear investment thesis explaining why a stock is undervalued, priced correctly, or overvalued

- A one-liner summary of key findings

- And specific price levels that would trigger reevaluation

It is a bit like a supervisor who would weigh and integrate the team's various perspectives.

To power this system, I use large language models from providers such as Anthropic, OpenAI, and Gemini. As new models are released, it is a constant effort to map the right model to the right task. To do so, I implemented a tournament-based system that lets a set of models compete on representative tasks; I then review which ones score best and assign the model to each agent accordingly.

In summary, the above methodology considers a stock undervalued when both its fundamentals and qualitative outlook rank well within its peer group, and its valuation offers an attractive risk-adjusted upside.

Benefits of AI in stock analysis

Beyond the obvious scale benefit, I see AI solving the critical issue of cognitive fatigue. Human analysts, no matter how skilled, have bad days and get tired. They might skim the details on the 50th company they analyze. The AI agents apply the exact same rigorous, granular scrutiny to Company #1 as they do to Company #1,000, without ego or exhaustion. And that level of consistency is necessary when trying to spot mismatches between business quality and market price across thousands of names.

To access the analyses generated by the AI hedge fund, feel free to visit Undervalued.ai's home page and search for a stock listed on the US stock exchanges.